Timing the Market - A Cautionary Tale of Charts

“The underlying driving force behind market timing decisions seems to be emotional – fear, greed, chasing performance – buying something after it has gone up, disappointment and sales after something has declined.” David Swensen, Former Chief Investment Officer, Yale University Endowment Fund

Market timing is the idea that you can predict the future direction of equity markets, and thus trade in and out of stocks accordingly to enhance performance. This desire is rational in that one is attempting to avoid downturns in the market by selling while remaining fully invested in bull markets. These decisions are often emotive reactions based on moves the market has already made. The difficulty is that no one has consistently been able to identify market tops and bottoms.

Many investors may feel nervous when the stock market is at an “all-time high.” Concerned about a potential fall, some may switch all or a portion of their investments to cash. The stock market hit a new high in mid-December 2023, and in January it was 3% higher. It went on to post another all-time high on February 23, 2024. The reality is that the market achieves an all-time high more often than one might expect. Of the 1,176 months since January 1926, the market was at an all-time high in 354 of them – that translates to about 30% of the time. Any glance at a long-term chart of the stock market would illustrate the opportunity cost of exiting the market and the challenge of re-entering.

U.S. Equity Large Cap Index: 1925-Present

Source: Stockcharts.com \ S&P 500 Index 1925-Present

As the charts above suggest, historically, to earn the long-term returns of the market, a remaining-invested strategy is superior to a trading one. High-return days occur randomly and often in down markets.

Missing the Market’s Best Days Has Been Costly

Sources: Ned Davis Research, Morningstar, and Hartford Funds, 1/24, S&P 500 Index Average Annual Total Returns: 1994-2023

The statistics of the above chart are instructive. The scenario compares the returns of $10,000 invested between 1994 and 2023, a 29-year period. Missing just ten of the best days in the last 29 years translates into 54% less return than being fully invested during the entire period. Extending this analysis to longer periods yields similar results. Analysis by Dimensional Funds covering the last 50 years indicates that just missing the best 15 days yields 35% less return.

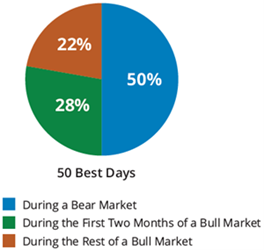

Contributing to the pitfalls of timing the market is that many of the best days take place shortly after the worst days. In 2020, the second-best day occurred right after the second-worst day that year. Interestingly, as the chart below shows, half of the best days in the market occurred during bear markets.

U.S. Equity Market’s Best Days: 1994-2023

Sources: Ned Davis Research, Morningstar and Hartford Funds, 1/24, S&P 500 Index 1994-2023

Finally, timing the market could subject the portfolio to capital gains taxes for accounts that are not tax-advantaged. Taking realized gains can forfeit compounding opportunities from a buy-and-hold strategy as well as push marginal income into higher tax brackets.

Why is it so challenging to time the market? You must be right twice, both on the sell decision and again in the subsequent repurchase. The odds that one will be able to make both decisions correctly to consistently beat the market are small. Although it is normal to feel anxious when the market is at an all-time high, history indicates that trying to time the market can be damaging to returns. Delta’s approach is to select stocks appropriate for long-term holdings that have competitive advantages, positive net cash flows, investment grade balance sheets and are good capital allocators. The key to investing is to be consistent and follow a discipline that mitigates emotive-led decisions and understands your tolerance for risk.

___________________________________________________________________________________________________________________________________________________________________

Company Comments

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

___________________________________________________________________________________________________________________________________________________________________

Microsoft Corporation { MSFT }

Founded in 1975, Microsoft is the world’s largest independent software developer. The company has experienced a renaissance under the leadership of Satya Nadella. He is the third CEO in the company’s history. Since becoming CEO in February 2014, Microsoft has quickly emerged as one of the most important cloud computing firms in the world, having more than doubled its market share in the public cloud space over the past few years. Corporate America continues to adapt to the cloud’s efficiencies. Azure, the firm’s cloud offering, has established itself as the No. 2 player in the space behind Amazon.

Microsoft is not only a leading cloud infrastructure provider, but it also sells a multitude of software programs hosted on the cloud, which provides differentiation for Azure to exploit. These products include Windows operating systems, Office business solution applications, Enterprise Resource Planning and Customer Relationship Management applications, LinkedIn talent, marketing and sales solutions, video games and its online search offering Bing. We believe the benefits of cloud computing – such as efficiency, flexibility, scalability and cost savings – will continue to drive enterprises away from on-premises computing to the cloud. Microsoft is positioned to continue to lead in this transition due to its massive installed base of enterprise solutions that allow its customers to remain in the same Microsoft environment as they transition to the cloud.

Office, Microsoft’s productivity software, has been reinvigorated by the launch of a cloud-based, subscription version known as Office 365. Around 1.5 billion workers globally use Office or Office 365 accessed through Azure. For mature businesses – such as Windows and Office – the company is moving from a transaction model to a subscription model, extending the lives of these businesses, expanding the market, and setting the stage for a stronger recurring revenue structure. Updates and software fixes will be easier, and there will be a higher capture of revenue as leakage from piracy is reduced. Microsoft’s transformation to a cloud-based software company should allow it to lower its distribution costs and strengthen profitability while focusing on its strengths in serving enterprise customers.

The Activision acquisition will significantly increase Microsoft’s gaming content offerings and help the company further transition to a digital cloud gaming provider, allowing gamers to stream across PCs, consoles and mobile devices.

Microsoft’s cloud business faces diverse competition from companies – for example Amazon, Google and Oracle – as well as software-centric companies – for example, Salesforce and VMware, Inc. As such, the company must continue to innovate even as it prolongs the life of its legacy products. Approximately one-third of the company’s workforce of 221,000 is dedicated to research and development (R&D). The company continually adds capabilities to its cloud offerings, enterprise productivity software suite and gaming. Microsoft’s strategy is to apply innovations across its product portfolio where possible. Microsoft spends 12% of its revenue on R&D, a key differentiator for the company.

Microsoft has invested over $4 billion in one Artificial Intelligence (AI) start-up (Anthropic) and is a preferred partner of Open AI. The company is already monetizing its AI investment by embedding it in a number of its software applications and cloud services. In the third quarter, six percentage points of Azure’s growth came from AI-adapted products, double the growth rate sequentially.

The company is acquisitive and does not shy away from making occasional large acquisitions. Its largest acquisition, Activision Blizzard, closed in October 2023 for $69 billion. Microsoft is a leading game provider through its Xbox 360 console and owns some of the most popular games, such as Halo and Minecraft. The acquisition will significantly increase Microsoft’s gaming content offerings and help the company further transition to a digital cloud gaming provider, allowing gamers to stream across PCs, consoles and mobile devices. Although competitive, the gaming market remains robust with three billion people actively playing games. Microsoft will continue to invest to improve its content and services to gain market share.

We anticipate that Microsoft will continue to internally develop and acquire a wide range of technologies and products while continuing to be a leading provider in fast-growing enterprise cloud computing. We expect its faster-growing businesses combined with its more mature business lines to lead to average growth of approximately 10% over our 10-year modeling period. With its increasing shift to high-margin revenue subscription software services, we believe operating margins of over 40% can be sustained.

Sysco Corporation { SYY }

Founded in 1969, Houston-based Sysco is the largest food service marketing and distribution company in North America. Sysco’s major customers include independent restaurants as well as schools, colleges, hotels, hospitals and other food service outlets. Sysco holds about a 17% market share – two times its largest competitor – in the $350 billion-plus food service market in the U.S. and Canada.

Sysco targets full-service independent restaurant operators. The company has nearly a 30% market share among this group. Sysco focuses on independent restaurants where it has a relatively higher degree of pricing power versus chain restaurants. Historically, Sysco has been able to pass along inflation adjustments without significant delays. Key drivers in the industry include prompt and accurate delivery of orders, competitive pricing, close contact with customers and the ability to provide a full array of products and services to assist clients in their food service operations. Sysco’s distribution network and scale are competitive advantages in an industry with high fixed costs, helping the company generate industry-leading returns on invested capital.

Sysco has the largest marketing and sales organization within the food service industry, which is a key differentiator. The company advises clients on how they can drive sales and minimize costs. Sysco specializes in assessing business operations and providing its customers with a range of ancillary services, such as menu planning advice, food safety training, inventory control, product usage and labor scheduling reports. These services establish a level of trust and dependence and give Sysco valuable information relating to extensions of customer credit and accounts receivable management.

Sysco exited the COVID-19 pandemic in a position of strength as a more normative environment returned as both the food-away-from home and independent restaurants regain share in overall food consumption.

Sysco is nearing completion of its 2021 roadmap, named Recipe for Growth, which has been funded by the elimination of $750 million in annual operating expenses. The plan’s goal is to help the company continue to grow 1.5 times faster than the overall food-service industry. Sysco’s objective is to provide the broadest assortment of food and supplies through a more flexible supply chain and to maintain the best sales consultants in the industry.

The company’s revenue growth will be driven primarily by acquisitions. Sysco’s size and free cash flow allow it to continue to be a consolidator in a fragmented industry. Acquisitions will primarily focus on product extensions in the U.S. and geographic expansion to position Sysco to sell additional products to new and existing customers. In addition, we believe Sysco’s size, financial strength, scale and broad product offerings provide competitive advantages, particularly during times of economic uncertainty. Customers can depend on Sysco’s product reliability and timely delivery, which has allowed Sysco to gain market share from competitors. Sysco exited the COVID-19 pandemic in a position of strength as a more normative environment returned with both the food-away-from-home and independent restaurants regaining share in overall food consumption.

Despite its industry dominance, Sysco faces some challenges beyond cyclical economic headwinds. The industry is highly fragmented and competitive. In addition to local and regional distributors, competition increasingly includes cash-and-carry wholesalers, such as Restaurant Depot, club stores and a growing prevalence of group purchasing organizations. As an industry consolidator, there is always the risk that Sysco will overpay for acquisitions and be unable to profitably integrate these new companies.

We estimate that Sysco will be able to grow revenue long-term at a mid-single-digit rate. The company should be able to produce operating margins averaging in the mid-single digits, with those margins trending higher over time. Using these assumptions, our stock valuation model indicates Sysco’s current stock price offers a long-term annual average rate of return of approximately 8%.

RTX Corporation { RTX }

RTX Corporation is the result of United Technologies spinning off Carrier Global and Otis Worldwide and merging with Raytheon Technologies Corporation after the end of the first quarter of 2020. The restructured company is an even balance between commercial and defense aerospace. It is a unique structure, as most of its competitors in the industry are skewed one way or the other. Both the aerospace and defense products that RTX manufactures are characterized by substantial upfront development costs that require substantial technical and engineering expertise. RTX’s markets are also distinguished by deeply entrenched customer relationships and a razor (product) and blade (parts) business model, all of which create strong barriers to entry and a significant moat for each of these segments.

RTX’s markets are also distinguished by deeply entrenched customer relationships and a razor (product) and blade (parts) business model, all of which creates strong barriers to entry and a significant moat for each of these segments.

In its defense segment, RTX manufactures missiles, missile defense systems and space systems that include satellites and navigational systems. Deterrence is expected to drive material investment in each of these exposures, and we believe that it will be difficult to decrease defense spending without sweeping political change. RTX is one of two leaders in short-range middle defense with its well-regarded and tested Patriot missile defense system. The trend is for continued investment in missile defense, as adversary states are actively developing hypersonic missiles that could penetrate current systems. Missile defense systems require high precision and integrated radar with substantial technical complexity leading to significant entry barriers and switching costs.

The commercial aerospace segment is comprised of Pratt & Whitney, a jet engine manufacturer. The segment develops, manufactures and services jet engines for civil and military purposes as well as auxiliary power units. Pratt is in the midst of a large ramp-up in the production and deployment of a Geared Turbofan engine used in the Airbus A320 aircraft. Jet engines are often sold at narrow margins to develop as large an installed base as possible, which in turn provides access to recurring, high-margin servicing revenue. Commercial engines are expected to last about 20 to 25 years, so a large installed base gives the company the ability to generate service and parts revenue for decades.

Collins Aerospace, another commercial division, manufactures highly integrated, mission-critical products, such as landing gear, sensors, avionics and flight controls. The certification process and technical know-how of these products give Collins a substantive competitive advantage. Switching suppliers for mission-critical products would require a substantial effort in redesigning the aircraft to accommodate the new product with attending production delays, updated maintenance procedures and federal recertification of the aircraft.

Both Airbus SE and Boeing Company are continually striving to reduce the margins of their suppliers. As a result, the supplier industry has consolidated, giving companies of size and scale like RTX more negotiating leverage on pricing that they would have as separate, independent entities.

Manufacturers periodically face quality control issues, and RTX is no exception. In the summer of 2023, the company discovered contamination in the metal used to make some engine parts. The contamination could cause cracks over time to form in some parts. RTX is working to accelerate fleet inspection and minimize the operational impacts of the recall. At the time of the powder issue, the company increased share purchases to $12.3 billion from $3 billion the prior year.

Greg Hayes, the CEO, will step down in May 2024 in a “planned leadership transition.” The President, Chris Calio, will assume the role of CEO. Calio has been with Pratt & Whitney since 2005 and was elevated to RTX’s Chief Operating Officer in 2022. Recently, he was charged with combining the company’s missile and defense division with the space division into a single business unit.

RTX is well-balanced between commercial aerospace and defense, which would partially cushion the combined firm from a downturn in either segment. We anticipate revenue growth over the forecast period of 5% along with operating margins reaching 12%. Based on our assumptions, our financial model indicates that at the current stock price, RTX offers a potential long-term annual return of approximately 10%.

SGS S.A. { SGSOY }

SGS is the world’s leading testing, inspection and certification company. The company creates value for a wide range of entities by monitoring and improving their productivity, quality, safety, efficiency, speed to market and risk management. The Swiss-based company has more than 96,000 employees and operates a network of more than 2,400 offices and laboratories around the world.

SGS has a very diverse portfolio of businesses both in terms of end-markets and geographies. The three main lines of business include testing, inspection and certification (TIC) services. These services are applied across a number of industry sectors, including agriculture, minerals, construction, oil/gas/chemicals, automotive and food to name a few. The TIC industry is diverse, encompassing activities as disparate as certifying adherence to government standards, operating, testing or inspection systems for corporations, testing products for safety and reliability and inspecting products to make sure they meet performance standards. The overall unifying concept of this business is that there is the need for testing, inspection and certification of products, services and systems by engineering experts that have a reputation of reliability and trustworthiness.

The TIC industry is a beneficiary of several global trends including increasing government regulations and environ-mental and safety concerns as well as digital technology and cybersecurity.

SGS’s revenue patterns tend to be relatively stable since a large portion is generated from recurring contracts. Customer retention is high, since it can be expensive and time-consuming to switch from one TIC company to another. Furthermore, many TIC services are highly specialized and can only be delivered by a limited number of certification companies. Another competitive barrier to entry is global scale. Size is a key advantage to capturing the largest and most complex contracts. Clients often seek TIC providers with appropriate financial strength and the ability to mobilize large teams to perform short-duration projects. SGS’s global network and increasingly strong brand facilitate continued market share gains from smaller local competitors. SGS is well-positioned to deliver profitable growth going forward.

SGS, with its approximate 15% global market share, is the leading company in an attractive industry. The TIC industry is a beneficiary of a number of global trends including increasing government regulations and environmental and safety concerns as well as digital technology and cybersecurity. Standards have been applied with growing intensity as more products are being manufactured overseas, creating a need to trace product origin and maintain quality. Increasing concerns around the environment, safety, quality and performance in all industrial and consumer products and foods should continue to drive increased product testing.

The company is broadly diversified across nearly all industries and regions and will be impacted by the cyclical ups and downs of the global economy. Its broad diversity across industries and global geographic footprint should help limit its downside. Further risks include a potential slowdown in international trade, increased protectionism, reputation risk and country risk.

We believe organic growth and market share gains should allow SGS to grow its revenues by 5% annually over the next decade. In addition, through cost efficiencies and adequate pricing, operating margins should average 15%. Our model indicates the company’s stock offers an average long-term annualized rate of return of approximately 10%.

Cracker Barrel Old Country Store, Inc. { CBRL }

Cracker Barrel Old Country Store, based in Lebanon, TN, operates more than 660 Cracker Barrel restaurants and gift stores in 45 states. Its locations welcome approximately 230 million guests in a normal year and, although highway travelers make up about 40% of visits, 60% are made up of locals. Restaurants generated 80% of the revenue in 2023, and the balance was contributed by the gift shop. The average check per guest in 2023 increased almost 10% over the prior year. The typical location serves an average of approximately 5,500 guests per week.

The format of the stores consists of a rustic old country store design offering a full-service restaurant menu for three meal periods. The menu features breakfast and home-style country foods. It also offers a wide variety of decorative and functional items such as rocking chairs, holiday and seasonal gifts, toys, apparel, cookware and foods. All stores are freestanding buildings and consist of 70% of the square footage dedicated to the restaurant, kitchen and service area with the remainder for the gift shop.

In October 2019, the company acquired 100% ownership of Maple Street Biscuit Company (MSBC). The concept serves biscuit-inspired entrees as well as freshly roasted coffee with a proprietary blend and a limited selection of beer and wine in certain locations. MSBC has a smaller footprint than the Cracker Barrell store and has operating hours limited to the breakfast and lunch segments. As of September 2023, the brand had 59 company-owned locations. Average annual sales are $1.2 million per unit.

New CEO Julie Masino has implemented strategic priorities to further leverage the Cracker Barrel brand as one of the strongest and most differentiated brands in the restaurant industry. Priorities include increased advertising to drive its unique, value brand image and to drive the mindshare of customers. Other improvements comprise increased servers during peak dining periods and refreshed restaurants with new décor and better lighting to improve the customer experience. The company’s operational efficiency measures include investments in technology and a cost-savings program that should improve profit margins and free cash flow over time. Although inflation has put pressure on margins in recent years, we believe the recent easing of food costs will be the major driver of both restaurant traffic and margins.

New CEO Julie Masino has implemented strategic priorities to further leverage the Cracker Barrel brand as one of the strongest and most differentiated brands in the restaurant industry.

Cracker Barrel hopes to drive revenue via its off-premises business, which gained traction during the COVID epidemic. Catering, take-out and delivery account for approximately 20% of the chain’s sales, a percentage that has not changed much even as customers returned to in-house dining. Cracker Barrel is increasing its digital footprint by starting a pair of virtual brands for take-out and delivery. The intent is to appeal to the customer who wants the convenience of carry-out but at a higher quality offering than most fast-food concepts.

The company continues to focus on generating shareholder returns through its capital investments, dividends and stock repurchases. Its Board of Directors has authorized a stock buyback program of up to $200 million, which replaced an earlier authorization. Based on our assumptions and our stock valuation model, we project Cracker Barrel’s current stock price offers a long-term annual rate of return of 13.5%.

Dated: March 18, 2024

Specific securities were included for illustrative purposes based upon a summary of our review during the most recent quarter. Individual portfolios will vary in their holdings over time in relation to others. Information on other individual holdings is available upon request. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Any projections are hypothetical in nature, do not reflect actual investment results and are not a guarantee of future results and are based upon certain assumptions subject to change as well as market conditions. Actual results may also vary to a material degree due to external factors beyond the scope and control of the projections and assumptions.